Institutional

DeFi

The Next Generation of Finance?

Institutional

DeFi

The Next Generation of Finance?

The Oliver Wyman Forum is committed to bringing

together leaders in business, public policy, social

enterprises, and academia to help solve the world’s

toughest problems. The Oliver Wyman Forum strives to

discover and develop innovative solutions by conducting

research, convening leading thinkers, analyzing

options, and inspiring action on three fronts: Reframing

Industry, Business in Society, and Global Economic and

Political Change. Together with our growing and diverse

community of experts, we think we can make a difference.

For more information, visit www.oliverwymanforum.com

Recognised for its global leadership, DBS has been named

“World’s Best Bank” by Global Finance, “World’s Best

Bank” by Euromoney and “Global Bank of the Year” by The

Banker. The bank is at the forefront of leveraging digital

technology to shape the future of banking, having been

named “World’s Best Digital Bank” by Euromoney and the

world’s “Most Innovative in Digital Banking” by The Banker.

In addition, DBS has been accorded the “Safest Bank in

Asia“ award by Global Finance for 14 consecutive years from

2009 to 2022.

DBS provides a full range of services in consumer, SME and

corporate banking. As a bank born and bred in Asia, DBS

understands the intricacies of doing business in the region’s

most dynamic markets.

For more information, please visit www.dbs.com.

Onyx by J.P. Morgan is at the forefront of a major shift

in the financial services industry. We are the first global

bank to offer a blockchain-based platform for wholesale

payments transactions, helping to re-architect the way

that money, information and assets are moving around

the world.

We work with large institutions, corporations and fintechs

who are interested in leveraging innovative technology

solutions to help solve real-world business problems at

scale. We have re-architected the infrastructure of value

transfer, using intelligent, real-time networks to help

unlock the potential of distributed ledger technology.

Institutions around the world work with us through

secure, open collaboration platforms that integrate

quickly and seamlessly across global markets.

Please visit www.jpmorgan.com/onyx for more

information.

SBI DAH endeavors to bring innovation to the financial

industry by building an ecosystem for issuance, custody,

management, and liquidity for digital assets. SBI DAH

has investments in key portfolio companies including

Sygnum, Boerse Stuttgart Digital Exchange among others

and leverages the SBI group’s broader global network of

subsidiaries and investments. Through SBI Digital Markets

and AsiaNext (a JV with the Swiss SIX group), two key

subsidiaries in Singapore, the group is growing its presence

in the region to help shape the digital asset ecosystem.

The SBI Group is a leading financial conglomerate based in

Japan. The SBI Group’s core businesses include Financial

Services Business, Asset Management Business, Private

Equity, Crypto-asset Business, and non-financial business.

Please visit www.sbidah.com and www.sbigroup.co.jp for

more information

The Monetary Authority of Singapore (MAS) is the central bank of Singapore. It seeks to

promote sustained and non-inflationary growth of the economy as well as foster a sound

and progressive financial services sector. Besides managing Singapore’s official foreign

reserves and the issuance of government securities, MAS also supervises the banking,

insurance, securities and futures industries, and develops strategies in partnership with

the private sector to promote Singapore as an international financial centre.

For more information, please visit www.mas.gov.sg

With inputs from

Foreword

The aim of this joint report by the Oliver Wyman Forum, DBS, Onyx by J.P. Morgan,

and SBI Digital Asset Holdings is to help business executives understand the

potential benefits of adapting decentralized finance (DeFi) protocols in the finance

industry using tokenized real-world assets. DeFi protocols are self-executing

applications on a blockchain that can automate financial services such as lending

and borrowing, trading, and asset management while reducing manual involvement

from intermediaries. Such protocols have emerged rapidly, capturing billions of

assets in the crypto-asset industry, but financial institutions need to address a

number of considerations before they can use DeFi protocols at scale. We believe

a version of DeFi called “Institutional DeFi”, which combines the innovations of

DeFi protocols with the safeguards of today’s finance industry, has the potential for

growth and transformative impact. This paper explains what industry participants

need to do to achieve regulatory clarity, drive commercial adoption, and get the

greatest benefits out of Institutional DeFi for their clients and themselves.

Contents

Executive Summary

5

Section 1: The Value of Institutional DeFi

8

1.1 Tokenization is already bringing new potential to money and assets

9

1.2 DeFi protocols enable new ways to deliver financial services

12

1.3 Safeguards are the key to Institutional DeFi

14

Conclusion: Now is the time to actively explore Institutional DeFi

16

Section 2: Institutional DeFi Design

17

2.1 Start by defining objectives of Institutional DeFi solutions

17

2.2 Make design choices that fit the objectives

18

Conclusion: There is no one-size-fits-all Institutional DeFi solution

24

Section 3: Institutional DeFi Design in Action

25

3.1 Introduction of Project Guardian

25

3.2 Project Guardian Pilot One

27

3.2A – Business Objectives: What did we set out to achieve?

27

3.2B – Design Choices: What did we do to make DeFi work?

30

3.2C – Lessons Learned to date: What needs to be done to reach scale?

34

Conclusion: Institutional DeFi is feasible, but work is needed to drive adoption at scale

36

Section 4: Strategic Implications for the Finance Industry

37

4.1 How the finance industry can foster Institutional DeFi

38

4.2 Playbook for financial institutions

40

4.2A Develop a house view on DeFi

41

4.2B Decide on a participation strategy

45

4.2C Get the organization ready

48

Conclusion: Four effective moves for seizing Institutional DeFi opportunities

49

Closing Remarks

50

Authors and Acknowledgements

51

Endnotes

53

Decentralized finance (DeFi), which uses blockchain-based smart

contracts to execute a variety of financial services activities, has

seized the attention of technology developers, investors, and financial

institutions. DeFi protocols have already enabled nascent markets in

the crypto-asset industry on public blockchains, such as borrowing and

lending as well as decentralized exchanges. Imagine the potential if

the technology were to be applied to streamline transactions in foreign

exchange, equities, bonds, and other real-world assets. This will require

the creation of digital representations, or tokens, of real-world assets

to bring them onto the blockchain. The cost savings and new business

opportunities of creating a “tokenized” version of real-world assets

for transacting through DeFi protocols could be significant for issuers

and investors, as well as for financial institutions that can adapt their

technology and business models.

That’s an alluring prospect, but many DeFi protocols today are not

designed for use in mainstream finance. Firms that wish to apply

DeFi in their client offerings must incorporate the same, if not higher,

levels of safeguards and security standards that have been developed

over decades in the finance industry.

This is where we look to the idea of Institutional DeFi – a system that

combines the power and efficiency of DeFi protocols with a level

of safeguards to meet regulatory compliance and customer-safety

requirements. Many existing DeFi protocols lack identity solutions

to enable institutions to meet anti-money laundering (AML), know

Executive

Summary

5

Institutional DeFi | Executive Summary

your customer (KYC), and combatting the finance of terrorism (CFT)

requirements. Cybersecurity is another major risk, as recent high-

profile hacks demonstrate. There is also limited, if any, recourse

for investors should something go wrong. Firms need to develop

safeguards to address these challenges before DeFi protocols can

be adopted at scale in mainstream finance.

To create viable Institutional DeFi solutions that fit their purpose

and ambitions, we believe financial institutions need to make

several key design choices to implement appropriate safeguards

and drive innovation. These design choices will influence everything

from the level of privacy and efficiency in transactions to the pace of

user adoption and the extent of interoperability with other tokenized

assets. The choices lie in three critical areas: 1)

blockchain – which

underlying network to build on and what information is visible to

whom; 2)

participation – the mechanisms that determine who can

develop and access solutions, and 3)

token design– how tokens

are issued, transacted, settled, and standardized.

In an effort to advance industry thinking on these issues, the

Monetary Authority of Singapore launched Project Guardian in

May 2022. The project aims to test the feasibility of applications in

asset tokenization and DeFi while managing risks to financial stability

and integrity. Project Guardian will help MAS build a framework for

a digital asset ecosystem, develop and enhance relevant policies, and

provide direction on required technology standards. The project’s

first pilot was being led by our co-authors DBS, Onyx by J.P. Morgan,

and SBI Digital Asset Holdings. The Project Guardian pilot carried out

transactions involving foreign exchange with tokenized deposits and

separate transactions with government bonds, in each case, on a public

blockchain network, using digital identity solutions and logic adapted

from existing DeFi protocols.

The pilot demonstrated the feasibility and transformative potential of

using DeFi protocols in financial markets with appropriate guardrails.

It also validated the crucial role of two key factors in this process:

1) the use of regulated institutions to act as “trust anchors,” issuing

and verifying the credentials of participating entities to establish

the identities of transacting parties and connect with existing legal

frameworks, and 2) the need for an agreed set of technical standards

6

Institutional DeFi | Executive Summary

around business logic and token standards for interoperability.

Both are essential elements for Institutional DeFi and can be helpful

across systems and jurisdictions to drive adoption, and improve

transaction efficiency for a globally integrated finance industry.

Broader efforts are needed, however, to unlock the full potential

of Institutional DeFi and make it scalable. The Project Guardian

pilot identified seven key areas where further work is needed,

such as legal clarity, adoption incentives, and technical standards

alignment, which are detailed in section 3. We believe these areas

need joint actions from multiple parties across regulators, financial

intermediaries, clients, and other third parties, including DeFi

communities. The joint actions should address legal and regulatory

uncertainties, establish shared standards, and seek to forge a

common vision of how the industry should operate.

Given the transformative potential of Institutional DeFi, financial

institutions need to develop a playbook for getting the most value

out of it. Institutional DeFi will likely vary by jurisdiction and market

structure, and we suggest three ways financial institutions should

start responding:

Develop a house view on Institutional DeFi implications across

business portfolios. We share potential future paradigms and their

implications for key sectors.

Decide on a participation strategy to adapt existing business and

embrace new opportunities enabled by Institutional DeFi. We suggest

several questions that can help firms on their journey.

Get the organization ready to fulfill its ambitions by developing the

required capabilities. We identify three areas, including organizational

structure, delivery model, and talent strategy.

7

Institutional DeFi | Executive Summary

Section 1

The Value of

Institutional

DeFi

Financial services are built on trust and

empowered by information. This trust rests

on financial intermediaries who maintain

the integrity of records covering ownership,

liabilities, conditions, and covenants, among

other areas, across a variety of siloed ledgers

that are separate from the means they use

to communicate. As each intermediary has

a different piece of the puzzle, the system

requires much post-transaction coordination

to reconcile the various ledgers and settle

transactions. For example, many securities

transactions, particularly cross-border ones,

can take anywhere from one to four days

to settle.

Distributed ledger technology (DLT), such

as blockchain, has the potential to resolve

some of those inefficiencies by presenting

transactional and ownership information

on a single shared ledger. The growing

acceptance of tokenization, which creates

digital representations of assets such as a

stocks and bonds on a blockchain, can extend

the benefits of DLT to enable exchange and

settlement of a wide range of asset classes.

Institutions can generate further efficiency

by adopting DeFi protocols, which use

software code to automatically execute a

range of financial transactions pursuant to

present rules and conditions.

We define

Institutional DeFi as the

application of DeFi protocols to tokenized

real-world assets, combined with appropriate

safeguards to ensure financial integrity,

regulatory compliance, and customer

protection. (It is important to note that in this

joint paper we do not refer to Institutional

DeFi as institutional players participating

in crypto DeFi.) The prize for innovators

who hone this model for use in the world’s

trillion-dollar finance industry could

be substantial.

8

Institutional DeFi | The Value of Institutional DeFi

Exhibit 1: What Is Institutional DeFi

Institutional DeFi

Real-world asset tokenization

Representation of real-world

assets on a mutualized ledger,

shifting from siloed records to

a shared one viewable by all

participants

DeFi protocols

Rapidly evolving area at the

vanguard of financial

services and digital assets;

providing services on a

blockchain settlement layer;

such as lending, trading,

investments, insurance, and

asset management

Appropriate Safeguards

Controls and security

standards for investor

protection and financial

stability, for example,

Know Your Customer,

trade surveillance; using a

public blockchain could

require more safeguards

+

+

Source: Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, SBI Digital Asset Holdings

1.1 Tokenization is already bringing

new potential to money and assets

Technology continually evolves and

modernizes financial services by creating

new ways of executing and recording

transactions. Each step in this evolution

brings new business opportunities. For

example, dematerialization replaced paper

certificates with digital ones in the form of

electronic book-entries, fostering the rise of

electronic payments and trading. That, in

turn, made securitization possible, which

added value to previously illiquid assets

such as mortgages.

Despite recent waves of digitization, trillions

of dollars’ worth of real-world assets are

recorded in a multiplicity of ledgers that

remain separate from messaging networks.

This means that financial intermediaries

have to record transactions on siloed ledgers

and then message each other to reconcile

their books and finalize settlement. The need

for coordination across ledgers and networks

between entities creates inefficiencies

that increase costs and risks, lengthens

settlement times, and in general adds

overhead to financial services.

The past few years have witnessed an

increased focus on blockchain technology

as a potential panacea for resolving these

inefficiencies. The promised value of

blockchain comes from combining ledgers

and networks in a way that allows multiple

parties to see the same information, hence

greatly reducing the need for reconciliation

after a trade or transaction. In addition

to creating a shared view of information

(transaction balances, ownerships, etc.),

blockchains also enable business rules and

logic to be executed and viewed with high

transparency and in a deterministic manner.

For example, lending business logic can be

codified transparently in smart contracts,

thereby enforcing adherence to rules and

automating settlement.

9

Institutional DeFi | The Value of Institutional DeFi

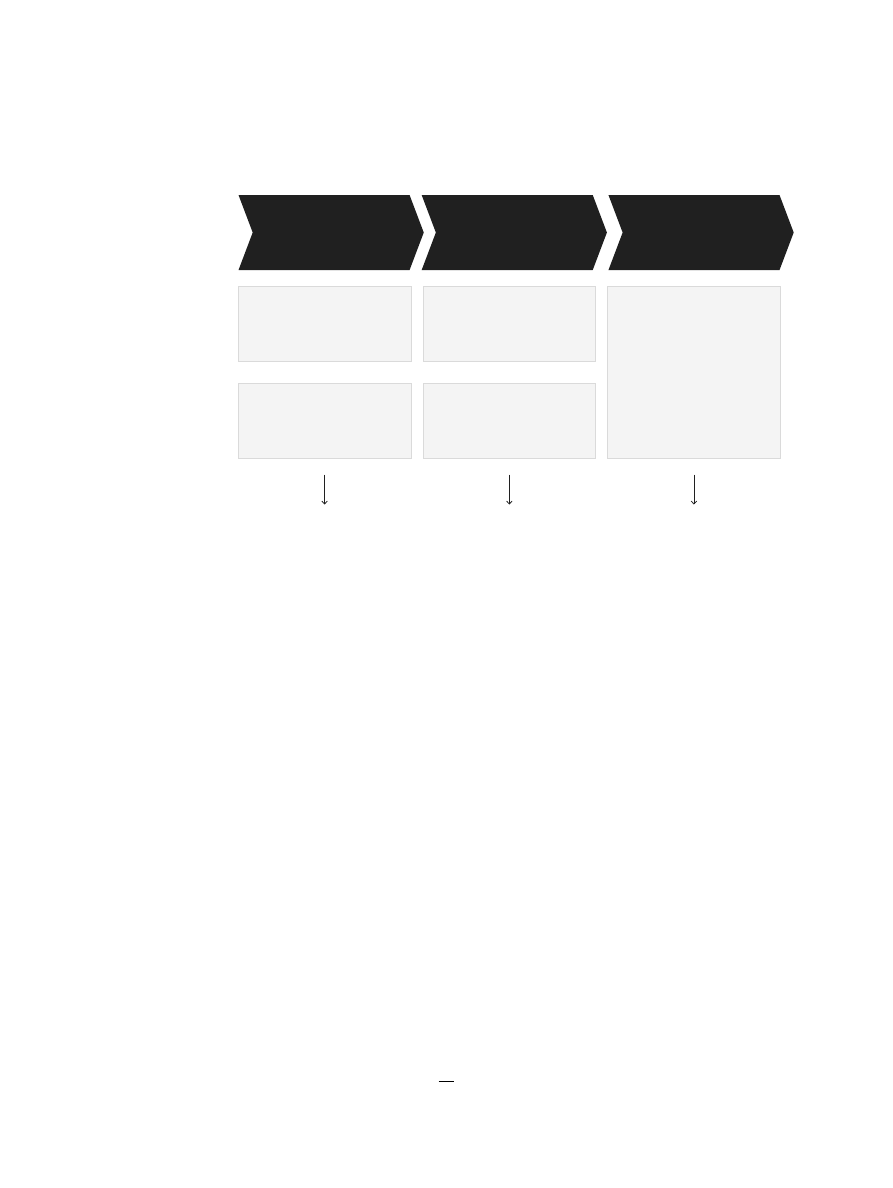

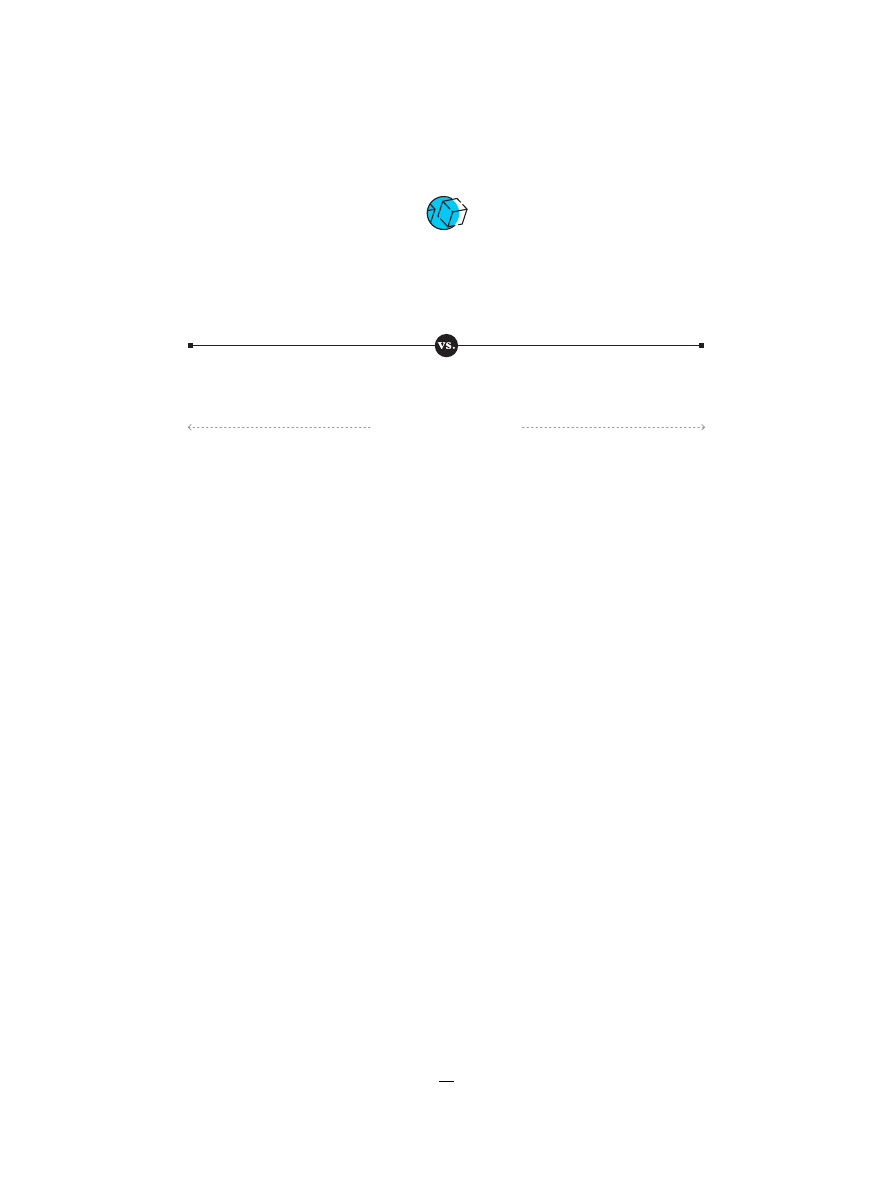

Exhibit 2: History of Asset and Money Representation

Physical form

Paper-based and

managed by

intermediaries

Digitized, but

distributed information

requires reconciliation

Digitized, and a single

network for both

transfer of value and

messaging

Electronic network

separate from

record-keeping

Finance

Manual servicing at

physical branches

Digital Finance

Automated services via

independent systems

Institutional DeFi

Self-executing

composable services

across network

Record keeping

Network

Financial service

innovation

Electronic form

Tokenized form

Physical venues

Source: Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, SBI Digital Asset Holdings

In the process of adopting blockchain

technology, financial firms are exploring

representing real-world assets as tokens on

a blockchain. Such tokenization can reduce

settlement risk and decrease settlement

times, which typically takes one to two

days even for low-risk assets such as G10

government bonds, by enabling so-called

“atomic” settlement – the instant exchange

of two assets on the condition that assets are

simultaneously transferred. No party to a

transaction is then left waiting for delivery.

The application of smart contracts in asset

tokenization also has delivered a number

of benefits, including enhanced and new

offerings. For example, J.P. Morgan leverages

tokenization to offer intra-day repo solutions

for clients on its Onyx Digital Assets

platform, and DBS Digital Exchange offers

corporates a platform to raise capital through

the digitization of their securities and assets,

with options to offer smaller denominations.

These tokenization benefits are also

welcomed by asset managers, as 70% of

institutional investors expressed willingness

to pay extra for increased liquidity and faster

asset turnover, according to a recent survey

conducted by Celent.

1

10

Institutional DeFi | The Value of Institutional DeFi

Tokenization efforts in the industry are well under way covering both payment instruments

and assets, which creates the potential for end-to-end asset exchange on blockchain.

Tokenized payment instruments

are gaining scale through public- and

private-sector efforts

Tokenized assets

are growing as multiple pilots have validated

their feasibility and value

88

%

91

%

Of global institutional investors are

comfortable with digital representations of

cash using blockchain-based technology,

according to a 2022 Celent survey

2

Of institutional investors are interested in

investing in tokenized assets, according to

a 2022 Celent survey

11

Tokenized payment instruments are being

explored by both the public and private sector.

On the public sector side, a 2021 survey of

81 central banks by the Bank for International

Settlements (BIS) found that 90% of central banks

were investigating the potential of central bank

digital currencies (CBDCs), including 26% that

were actively developing CBDCs or conducting

pilot projects.

3

The transaction volume of China’s

digital yuan, or e-CNY, reached RMB 100 billion

($13.9 billion) at the end of August 2022,

4

nearly

three years after its launch. The European Central

Bank in September selected five companies to

develop potential user interfaces for a digital

euro; it expects to complete its investigation

on whether to launch a CBDC in October 2023.

Central banks are broadening the scope of their

CBDC experiments. As of October 2022, the BIS

was running seven CBDC projects with various

member central banks.

5

More recently, the

Banque de France announced a new project to

look at using DeFi for wholesale CBDC liquidity

management.

6

On the private sector side, privately issued

stablecoins, which are cryptocurrencies typically

pegged to fiat money such as the US dollar,

have grown to a nearly $150 billion market.

7

There are increasing efforts from regulators to

clarify the status of stablecoins. Recently, MAS

published a consultation paper to support the

development of stablecoins as a credible medium

of exchange in the digital asset ecosystem.

8

In 2022, the European Union agreed on the

first major regulatory framework for the crypto-

asset industry, including stablecoins.

9

Japan

also passed a bill providing a legal framework

for stablecoins that allows licensed banks,

money transfer agents, and trust companies

to issue them.

10

We see many firms entering the space across

multiple asset classes including equities, bonds,

real estate, commodities and others. For example,

J.P. Morgan’s intra-day repo application on

Onyx Digital Assets has processed more than

$430 billion of repo transactions since its launch

in November 2020; the daily transaction volume

of Broadridge’s Distributed Ledger Repo platform

using tokenized government bonds reached

$35 billion in the first weeks after launch;

12

DBS has successfully issued the DBS Digital

Bond in May 2021 via security token offering

(STO); Mata Capital, a French asset manager,

tokenized €350 million ($343 million) worth of

funds.

13

Last year, Switzerland implemented a

so-called DLT Act granting tokenized securities

the same legal status as traditional ones.

14

Furthermore, in May 2021, Germany’s Parliament

passed a law allowing securities to be issued in

electronic form, not paper, enabling the issuance

of tokenized assets. The European Investment

Bank subsequently issued a digital bond on a

public blockchain in 2021 under this German law.

15

11

Institutional DeFi | The Value of Institutional DeFi

1.2 DeFi protocols enable new ways

to deliver financial services

In parallel to industry efforts to develop

real-world asset tokenization, the concept

of decentralized finance has flowered in

the public crypto-asset space. DeFi, as it is

popularly known, refers to decentralized

applications (DApps), which provide

financial services via sophisticated and

automated computer code on a blockchain as

the settlement layer. These services include

payments, lending, trading, investments,

insurance, and asset management. DeFi

protocols are the code and procedures

that govern these applications. These

protocols typically operate without

centralized intermediaries or institutions,

use open-source code, and allow for flexible

composability (code or applications can

be taken from one protocol/service and

plugged into another).

DeFi has rapidly emerged in the past

three years and grew more than tenfold to

$160 billion in 2021 in terms of total value

locked before retreating to stand at a little

over $50 billion as of October 2022.

16

DeFi

innovations have flourished across various

financial ecosystems and attracted billions

of dollars of liquidity across decentralized

exchanges (such as Curve and Uniswap),

lending protocols (such as Aave and

Compound), and other DeFi solutions,

such as liquidity staking and collateralized

debt positions, which lock up collateral in a

smart contract in exchange for stablecoins.

Some noteworthy innovations in the DeFi

space involve crypto lending/borrowing

protocols and decentralized exchanges:

• Liquidity pools, for instance, create

all-to-all markets. These pools link

buyers and sellers along with liquidity

providers in decentralized exchanges,

or DEXes, and lenders and borrowers in

lending protocols. Aave and Compound

are examples of large crypto lending

and borrowing protocols in terms of

total value locked,

17

whose operations

involve liquidity pools. Both retail and

institutional investors can deposit, borrow,

or trade crypto from the pool using

business logic that is governed by smart

contracts. If pools are on the same chain

or made interoperable, this aggregates

liquidity by attracting more investors.

• Automated market markers (AMM) provide

a new method of price discovery. An AMM

facilitates buy and sell orders in a self-

executing manner, always standing ready

to provide quotes and setting a price based

on a predefined, transparent formula

considering supply and demand. Uniswap

and Curve are examples of a decentralized

crypto exchange that uses an AMM. When

a user wants to swap crypto A for crypto

B, the AMM automatically calculates how

much crypto B the user can get and at

what price rather than relying on a market

maker to quote a price or to match a buyer

and a seller.

12

Institutional DeFi | The Value of Institutional DeFi

DeFi, as described above, is prevalent in the

public blockchain space and applies mostly

to transactions in the largely unregulated

crypto-asset industry. Yet the logic

embedded in DeFi protocols, which are

programmable, self-executing business

processes, can be applied to interact with

any tokenized asset.

Building full-scale financial services that

leverage tokenization and programmability

could have far-reaching implications for

the finance industry. It could generate

substantial cost savings, as code dramatically

reduces middle and back-office operations

across firms and intermediaries. In

the exhibit below we list some notable

benefits of DeFi solutions. New business

opportunities are also likely to emerge as

financial institutions take advantage of the

composability of DeFi protocols, packaging

multiple DeFi protocols together to offer

new solutions. First, however, firms must

adapt the DeFi protocols to the regulatory

standards of today’s trillion-dollar markets

for money, stocks, bonds, and other assets.

Exhibit 3: Notable Benefits of DeFi

Atomic settlement reduces risk by providing a secure way to deliver securities for payment

Mutualized and transparent ledgers facilitate real-time value movement, cheaper settlement

Composable nature (ability to interact with one another) of DeFi protocols

allows for seamless collaboration across multiple services

Interoperability across asset classes and markets aggregates liquidity

and enables a more globally integrated finance industry

Programmable logic allows automation of multi-party operational activities and thus

reduces middle- or back-office overhead such as transfers and post-trade reconciliation

Transparent and automated business logic enables new product features,

such as liquidations for collaterals and new product offerings

Innovative DeFi solutions amplify liquidity of tokens and tokenized real-world assets,

given lower participation threshold, such as decentralized exchanges

Source: Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, SBI Digital Asset Holdings

13

Institutional DeFi | The Value of Institutional DeFi

1.3 Safeguards are the key to

Institutional DeFi

Today’s finance industry rests on an

array of safeguards that protect investors

from fraud and abusive practices, combat

financial crime and cyber malfeasance,

maintain investor privacy, ensure that

industry participants meet certain minimum

standards, and provide a mechanism

for recourse in case things go wrong.

Institutional DeFi will need to incorporate

the same, if not higher, level of standards to

meet regulatory requirements, create trust,

and drive adoption by issuers, investors,

and financial institutions.

Here are some of the key safeguards needed

to build DeFi-based solutions for institutions:

• AML/KYC risk controls. Mechanisms

that ensure AML/KYC compliance for

participants can avert the potential legal

liability of dealing with sanctioned parties

or unqualified investors, and also prevent

inadvertently enabling or participating in

money laundering. Designing appropriate

risk controls however are not easy. In

2021, financial institutions were fined

$2.7 billion for their deficiencies and

failures in AML compliance policies,

procedures, and processes.

18

To avoid

the severe consequences that could

arise from control failures, the average

mid-size to large organization spends

$22.7 million annually on financial

crime compliance operations to build up

effective standards.

19

Appropriate controls

are needed if regulated financial activity is

to take place through DeFi protocols, and

regulators have begun to set expectations.

In August 2022, the U.S. Department of

the Treasury’s Office of Foreign Assets

Control (OFAC) imposed sanctions on

Tornado Cash, a cryptocurrency mixer

that facilitates anonymous transactions

by obfuscating their origin, destination,

and counterparties, alleging that it had

facilitated the laundering of more than

$7 billion worth of cryptocurrency.

20

Blockchain technologies may offer novel

ways of ensuring appropriate controls

at lower cost. For example, there are

methods for ensuring compliance with

AML/KYC without necessarily revealing

one’s personal information, such as using

zero-knowledge proofs combined with

pseudonymous identity mechanisms.

• Data privacy. Data privacy is crucial for

clients in certain segments, in particular to

protect their trading history and positions

for certain asset markets. Information on

public blockchains is permanently visible

to all by default, and investor orders can at

times be inferred from publicly available

data, something that becomes increasingly

more likely as time goes on and data

is accumulated. For example, whale

tracking tools on Twitter and Telegram

are widely used by the public to track

large crypto-asset transactions done via

decentralized exchanges and other DeFi

protocols, whereby people have strong

assumptions or hypotheses on who these

whales (investors holding a vast number

of crypto-assets) are.

21

In the finance

industry, client information in respective

transactions is masked and protected

through brokers, without being revealed

to the market. Appropriate privacy

protections will be necessary.

• Cybersecurity protections. While

almost anything digital can be vulnerable

to hackers, cybersecurity protections

are especially important for digital

assets and DeFi protocols due to the

nature of blockchain. Although the

14

Institutional DeFi | The Value of Institutional DeFi

underlying blockchain technology

makes it difficult to alter data, firms

seeking to develop Institutional DeFi

solutions must address cybersecurity

vulnerabilities in cross-chain bridges,

private digital keys, and on-chain price

oracles, as well as guarding against market

manipulation. Such controls are needed

to enhance client trust and protect the

safe ownership of digital assets. A rise

in thefts from DeFi protocols led to a

58% increase in crypto hacking losses,

to $1.9 billion, in the first seven months

of 2022.

22

Bridges connecting different

networks are particularly vulnerable, as

hackers demonstrated in July 2021 by

attacking the cross-chain DeFi platform

Poly Network, and causing roughly $600

million in losses in Ethereum and other

tokens.

23

Users manage their own private

keys to access their crypto assets, which

can also compromise security. Losses due

to compromised private keys have totaled

$274 million in the first eight months of

2022 alone.

24

• Mature governance and conduct

models. Reliable DeFi protocol

governance and stakeholder conduct

standards are needed to ensure that the

quality of Institutional DeFi solutions

offered are in alignment with financial

services professional standards. Financial

institutions are highly regulated with

mature quality assurance processes.

For example, there are more than nine

different federal financial regulators in the

United States on top of multiple regulators

in each of the 50 states.

25

Multilateral

organizations help coordinate financial

regulation internationally. Banks invest

over $270 billion a year and dedicate an

average of 10% to 15% of their staff to

comply with regulatory obligations.

26

Standards for conduct exist for both

institutions and individuals. Existing

DeFi protocols are based on different

governance and conduct assurance

mechanisms, most often done through

governance tokens that bestow holders

with voting rights. This is similar to most

common equity structures but without

the same level of corporate governance.

Also, many DeFi protocols have a very

high concentration of voting control:

Research by Chainalysis into 10 major

governance tokens found that fewer

than 1% of token holders held 90% of

the voting rights.

27

Indeed, participants

could consider whether to and how to

cover DeFi protocols under a corporation

construct – such as trusts, special purpose

vehicles, or other limited purpose

corporations – to allow for structured

governance and liability recourse.

• Proper recourse mechanisms. Recourse

and dispute management should be

properly established upfront. Incidents

such as theft or loss due to operational

errors can occur in any financial system.

The finance industry today is built with

robust recourse mechanisms or legal

remedies to protect users and investors

in most cases. For instance, the London

Court of International Arbitration, one of

the world’s leading arbitral institutions,

managed 86 international dispute cases

from the banking and finance industry

in 2021.

28

Such mechanisms are lacking

in public DeFi solutions, giving rise to

uncertainty in arbitration procedures.

When a hacker stole $130 million in

crypto assets from users of DeFi platform

BadgerDAO, they were unable to afford

full restitution immediately with a mere

$53 million in their treasury and no

insurance coverage.

29

Without an available

legal recourse mechanism, this left a

handful of affected users uncompensated.

• Legal clarity around smart contract-

based business activity. The legal status

of financial business activity has been

15

Institutional DeFi | The Value of Institutional DeFi

continuously clarified by countless acts

of legislation and major litigation efforts

over past decades. The UK High Court,

for example, typically hears 80 to 100

important banking and finance cases

annually.

30

That level of clarity does not

yet exist for smart contract-based DeFi

activity. According to international law

firm Norton Rose Fulbright, it remains

unclear which smart contracts are legally

enforceable, which could depend on

the intentions of contracting parties or

local jurisdictions.

31

In the United States,

the enforceability and interpretation of

contracts in the United States is commonly

governed by state law. Some states such

as Arizona and Nevada have amended

their respective laws (such as the

Uniform Electronic Transactions Act)

to explicitly incorporate blockchains

and smart contracts.

32

Some code-only

smart contracts would be enforceable

under state laws governing contracts.

The International Swaps and Derivatives

Association (ISDA) also developed

legal guidelines for smart derivatives

contracts to provide general guidance

for different jurisdictions.

33

More legal

clarity in commercial law is necessary to

reinforce these requirements and foster a

trusted environment for smart contract-

based business.

Conclusion

Now is the time to actively explore Institutional DeFi

The foundation for Institutional DeFi is being established by the growth

of real-world asset tokenization and the innovations observed in DeFi.

Financial institutions have the opportunity to transform parts of their

business by adapting DeFi protocols and combining them with the level

of safeguards that regulators and clients expect. Institutional investors’

appetite for digital assets is growing and they are willing to pay extra

for increased liquidity and faster transactions. 88% said they are still

planning to move forward with current plans around digital assets

despite market downturn.

34

In May 2022, the Monetary Authority of Singapore launched Project

Guardian to test the feasibility of applications in asset tokenization and

DeFi while managing risks to financial stability and integrity. Project

Guardian will help MAS build the digital asset ecosystem framework,

enhance and develop relevant policies, and provide direction on the

technology standards. Sections 2 and 3 of this report will explore how

financial services providers could adopt Institutional DeFi based on

different considerations, leveraging findings from the first pilot under

Project Guardian. Section 4 will discuss how financial institutions

should collaborate to get the most out of the transformation.

16

Institutional DeFi | The Value of Institutional DeFi

Section 2

Institutional

DeFi Design

While Institutional DeFi has potential,

financial institutions need to consider areas

where tokenization and programmability

are most valuable, and tailor DeFi protocols

for their purposes accordingly instead of

simply reusing what works in the crypto-

asset industry.

2.1 Start by defining objectives of

Institutional DeFi solutions

Institutions interested in exploring

Institutional DeFi solutions should start by

asking themselves, “why DeFi?” The answer

will depend on the commercial viability,

adoption feasibility, and competitive

advantage of such a solution. Objectives

could range from creating new products and

reducing data reconciliation tasks, to cutting

costs and speeding up settlement times.

Firms also need to consider a number

of broader objectives when designing

Institutional DeFi solutions. These

should include:

• Ecosystem objectives, such as

encouraging widespread adoption by

providing seamless interconnectivity to

and compatibility with existing trading

systems, preparing for interactions

with upcoming CBDC frameworks, and

fostering an open innovation environment

that encourages the development of

market-driven solutions

• Protection objectives, such as ensuring

compliance with the existing legal and

regulatory frameworks, allowing access

to only qualified users, and mitigating

various financial and operational risks,

including cybersecurity risks.

17

Institutional DeFi | Institutional DeFi Design

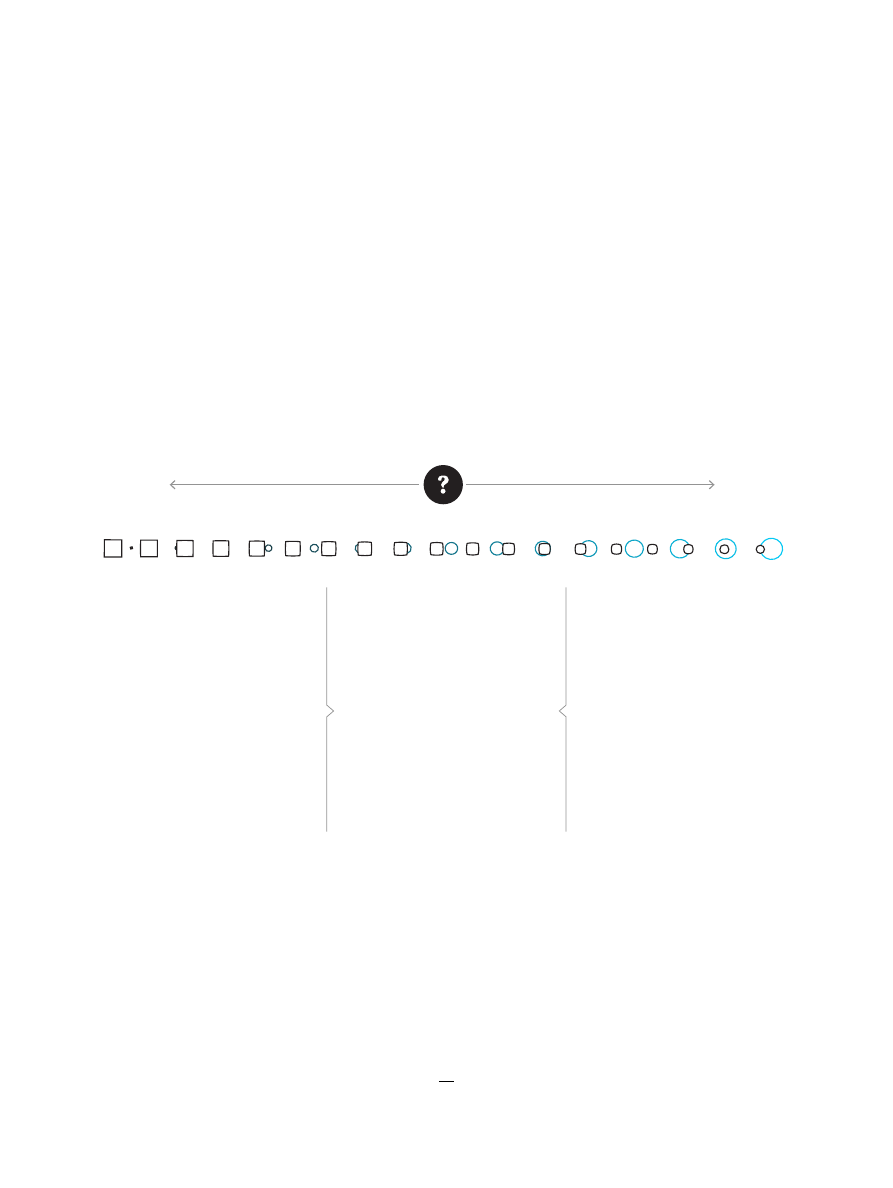

2.2 Make design choices that fit the

objectives

After firms have established their objectives,

they need to make choices in three key areas:

1)

blockchain – which underlying network

to build on and what information is visible to

whom; 2)

participation – the mechanisms

that determine who can develop and access

solutions; and 3)

token design – how

tokens are issued, transacted, settled,

and standardized.

It is critical that firms weigh the options and

their associated trade-offs carefully, as these

design choices are paramount in influencing

how the offerings achieve their objectives.

Exhibit 4: The Three Key Design Choices

Deployment

Access & usage

Token

issuance

Token

standards

Settlement

recognition

Network type

Data security & visibility

Binary choice

Spectrum of options

Participation

Token Design

Blockchain

Source: Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, SBI Digital Asset Holdings

:

18

Institutional DeFi | Institutional DeFi Design

Exhibit 5: The Three Key Design Choices – Blockchain

Blockchain

Blockchain refers to the type of network used, along with the level of data security and privacy.

Public

permissionless

Public

permissioned

Network type

Transparent

Private

Data security & visibility

Spectrum of choice

Network type

Network type refers to the underlying

network and database used to deploy an

Institutional DeFi solution with asset tokens.

This design choice is critical because it

affects so many important design objectives,

such as user access, interoperability, and

the strength of the developer ecosystem.

Public permissionless networks, such as

Ethereum and Polygon, impose no restriction

on access, and therefore have the potential

to encourage wider participation. They are

better equipped to facilitate interoperability

with existing digital assets and DeFi

protocols, which are on public permissionless

networks. There is already a wide base of

DeFi developers and open-source code that

have been tested and deployed on public

permissionless networks. This helps kickstart

and facilitate continued innovation, using

software components and applications that

are leverageable and composable. On the

flipside, this openness is also a potential

source of risk unless additional safeguards

are put in place.

Public permissioned networks, on the other

hand, can facilitate the use of controls

to authorize user access and restrict the

visibility of transactions on these networks.

This enables easier implementation of checks

and balances, along with traceability for

investigation purposes. As Institutional DeFi

models are still being explored, it is possible

a public permissionless blockchain could be

modified to ensure it is usable at scale by

institutional participants.

19

Institutional DeFi | Institutional DeFi Design

Data security and visibility

This informs the level of data transparency

of the solution, and its implied level of

data security. Data transparency is itself

a multifaceted concept and the choices

vary along a spectrum. On one end of the

spectrum, all transaction data is transparent

and available for all participants to view,

as is common with many public blockchains

today. On the other end of the spectrum,

participants may access only data relating

to their own transactions. Function-level

access management can provide different

levels of access to users, while encrypting

data and providing a viewing key to

selected participants can enable authorized

viewership. Moreover, different techniques,

such as zero-knowledge proofs (ZKP) and

ensuring DeFi protocol uses only private

messages, can be implemented for data

privacy on public blockchains.

The choice of transparency level

primarily depends on the solution’s value

proposition – but data ideally should be

private while discoverable to customers

or authorized stakeholders (such as

regulators). For example, the preferred

approach for a central limit order book-based

venue may be to make order and transaction

data available, while a dark pool solution may

prefer to conceal order information.

Mechanisms for data management and

protection need to be properly designed to

comply with regulatory data requirements

to prevent issues introduced by DeFi such as

maximal extractable value (MEV), where each

of the validators or “miners” updating the

blockchain can determine which transactions

are executed and when, thus affecting market

prices and opening the door to front-running

and other forms of market manipulation.

35

This is especially important for solutions on

the public blockchain as data is permanently

and immutability recorded on a publicly

available ledger, introducing a higher risk

of loss of privacy.

20

Institutional DeFi | Institutional DeFi Design

Exhibit 6: The Three Key Design Choices – Participation

Fully open

Assurance-based

Deployment

Permissionless

Permissioned

Access & usage

Spectrum of choice

Spectrum of choice

Participation

The choice of participation mechanism for an Institutional DeFi solution is nuanced and never binary.

There is a spectrum of choice regarding protocol deployment and access and usage.

Deployment

This choice governs how new smart

contracts and protocols are developed

and deployed, and embodies different

approaches to innovation and risk. On one

end of the spectrum, in a fully open model,

anyone can develop and deploy smart

contracts. This lowers barriers for application

development and encourages competition,

but it also entails risk as there are fewer

checks and balances before protocols are

deployed. This is not to say that assurance

standards are not used. For example,

some DeFi protocols today make use of

code audits. But such standards are not

mandated nor instituted for deployment.

On the other end of the spectrum, in an

assurance-based model, control and review/

approval mechanisms are put in place to

ensure adherence to specific standards

before deployment. These can be industry

standards widely accepted by institutional

investors and clients or standards instituted

through regulatory requirements. One

approach is to allow only selected developers

or firms to develop new processes. Another

approach is to ensure specific checks are

made to protocols, allowing only verified

protocols to be deployed.

21

Institutional DeFi | Institutional DeFi Design

Access and usage

This design choice relates to how controls

are put in place to manage user access and

usage. Restrictions can be imposed at the

service level (such as by controlling who

can access a liquidity pool) or at the level

of underlying functions (for example, by

controlling trading permissions, such as

instrument types and ticket size).

A permissionless participation model is

one where anyone can access the DeFi

protocols and use all functions without

restrictions (such as the Uniswap DEX),

while a permissioned participation model

is one where only authorized or verified

participants can access specific services

and use selected functions. While a

permissionless participation model could

help maximize the potential userbase and

foster growth, a permissioned participation

model helps comply with regulatory

requirements (such as KYC, qualified access)

by ensuring only the right participants can

use the appropriate functions. Note that a

permissioned model can still be enabled

on a public permissionless blockchain,

via access management mechanisms.

22

Institutional DeFi | Institutional DeFi Design

Token issuance

Non-native tokens are issued to represent

existing real-world assets. These non-native

tokens are bound to existing off-chain

processes and control mechanisms, such as

custody and reconciliation. For example, on

the Onyx Digital Assets platform, securities

accounts holding US Treasuries maintained

by J.P. Morgan for the benefit of its clients

are tokenized to enable intraday repo

transactions. On the other hand, real world

assets can be issued directly on a blockchain

as native tokens, such as through security

token offerings (STO). It is worth noting that

asset tokenization is rapidly evolving, and

there may be more ways to issue tokens in

the future.

There is currently legal uncertainty involved

for both native and non-native tokens.

Depending on the nature of the native token’s

asset class, there can be a lack of legal clarity

on whether such native tokens can exist by

themselves and rely on the blockchain alone

for record of its existence. For example,

bonds in the EU have to be registered with

a central securities depository (CSD), and

having a natively issued bond token without

separately registering with the CSD may not

meet such requirement. We note that this

leaves space for innovation in regulation

as well as the creation of blockchain-native

CSDs and similar actors. For non-native

tokens, there are considerations such as on-

chain settlement finality, which we discuss

in the next sub-section.

Both non-native tokens and native tokens

can interact with DeFi protocols, allowing

for automatic execution of asset servicing

and transactions without the need to rely on

legacy systems. However, transactions with

non-native tokens may ultimately require

interactions with off-chain processes as

noted above. The choice of token issuance

will depend on the nature of the asset which

is intended to be reflected, whether such

asset requires linkage to an off-chain asset,

Exhibit 7: The Three Key Design Choices – Token Design

Non-native

Native

Token issuance

n/a

n/a

Token standards

Choice of standards

Token Design

This refers to how a token is issued, transacted, settled, and standardized.

On-chain

settlement

Off-chain

settlement

Settlement recognition

23

Institutional DeFi | Institutional DeFi Design

whether blockchain ledgers may serve as the

determinative books and records in respect of

the issuance and ownership of such asset, and

whether there is the desire or need to tokenize

an existing asset that lives in legacy off-

chain systems.

Settlement recognition

Settlement recognition depends on whether

or not a token transfer on-chain is recognized

by law, regulation, or contractual arrangement

as a final transfer. This is a notable issue for

consideration in respect of non-native tokens,

where additional steps may be required to

be taken with respect to the off-chain asset

being represented. However, as noted above in

respect of CSD registration requirements, this

issue may arise due to regulation in respect of

native tokens as well. Off-chain settlement is

when a token transfer is not recognized as a

transfer of the underlying asset. In this case,

settlement finality is recognized off-chain,

in which an off-chain ledger is updated to

reflect ownership change. On-chain settlement

is when settlement finality is recognized

on-chain, whereby the on-chain ledger is

recognized as the single source of truth for

transfer and ownership.

The determination as to whether settlement

can be recognized on-chain mainly depends on

whether regulators and transaction participants

can legally recognize the blockchain records

as the final books and records of transactions,

allowing the blockchain to function also as

a de facto ownership ledger. This requires

an understanding of the regulation and

commercial law applicable to the transaction at

issue, as well as any contractual arrangements

in place. The analysis here will determine

whether transactions need to rely on legacy

ledgers and processes, or whether legacy

systems can be entirely replaced.

Token standards

Token standards are the set of principles on

which tokens are issued and smart contracts

are developed. These standards influence

the ability to interact with different DeFi

protocols, and hence the interoperability and

functionality, of the asset tokens. Different

public standards might be appropriate

depending on the type of token to be issued.

For example, the ERC-721 standard is designed

for non-fungible tokens (NFTs) while ERC-

1155 is suitable for both fungible and non-

fungible tokens and can be explored for

tokenized assets.

Conclusion

There is no one-size-fits-all Institutional DeFi solution

Design choices for Institutional DeFi solutions need to be tailored

for specific, prioritized business objectives. However, a specific

design choice may help achieve one business objective while imposing

limitations on another. As such, the task for any firm considering an

Institutional DeFi solution is to choose a complementary set of options

within each design choice to address its business objectives, taking into

account asset classes, jurisdictions, and the target value proposition.

24

Institutional DeFi | Institutional DeFi Design

Section 3

Institutional

DeFi Design in

Action

Experimentation is crucial to understanding

different approaches to Institutional DeFi.

Finance industry participants around the

world are increasingly conducting pilots

and experiments to explore different design

objectives and choices.

This report draws on the hands-on

experience of the co-authors in running

a joint pilot under Singapore’s Project

Guardian. The Monetary Authority of

Singapore (MAS) launched this collaborative

initiative with the financial services industry

to explore the economic potential and

value-adding use cases of asset tokenization

and DeFi. Using a controlled, sandbox

environment, it aims to test the feasibility

of applying asset tokenization and DeFi

protocols, while managing financial

stability and integrity.

3.1 Introduction of Project

Guardian

Project Guardian is designed to help MAS

build a digital asset ecosystem framework,

develop and enhance relevant policies, and

provide direction on technology standards.

Project Guardian will test the feasibility of

applications in asset tokenization and DeFi,

while managing risks to financial stability

and integrity. The central bank aims to

develop and pilot use cases in four main

areas (see next page).

25

Institutional DeFi | Institutional DeFi Design in Action

Exhibit 8: Project Guardian objectives

Open, interoperable networks

Avoid fragmented and private

exchanges or markets

Asset tokenization

Ensure operational feasibility of

asset tokens

Institutional-grade DeFi protocols

Mitigate market manipulation

and operational risks

Trust anchors

Ensure trading with verified,

trusted counterparties

Open, interoperable networks

Explore the use of public blockchains to

build open, interoperable networks that

enable digital assets to be traded across

platforms and liquidity pools. This includes

interoperability with existing financial

infrastructure. Open, interoperable networks

can mitigate against the formation of

walled gardens in digital exchanges and

fragmented private markets.

Trust anchors

Establish a trusted environment for the

execution of DeFi protocols through a

common trust layer of independent trust

anchors. Trust anchors are regulated

financial institutions that screen, verify,

and issue Verifiable Credentials to entities

that wish to participate in DeFi protocols.

This ensures that participants interact only

with verified counterparties, issuers, and

protocol developers.

Asset tokenization

Examine the representation of securities

in the form of digital bearer assets and the

use of tokenized deposits issued by deposit-

taking institutions on public blockchains.

The project aims to build upon existing

token standards, incorporate trust anchor

credentials, and enable asset-backed tokens

to be interoperable with other digital assets

used in DeFi protocols on open networks.

Institutional-grade DeFi protocols

Study the introduction of regulatory

safeguards and controls into DeFi protocols

to mitigate against market manipulation

and operational risk. The project will also

examine the use of smart contract auditing

capabilities to detect code vulnerabilities.

Source: Monetary Authority of Singapore

26

Institutional DeFi | Institutional DeFi Design in Action

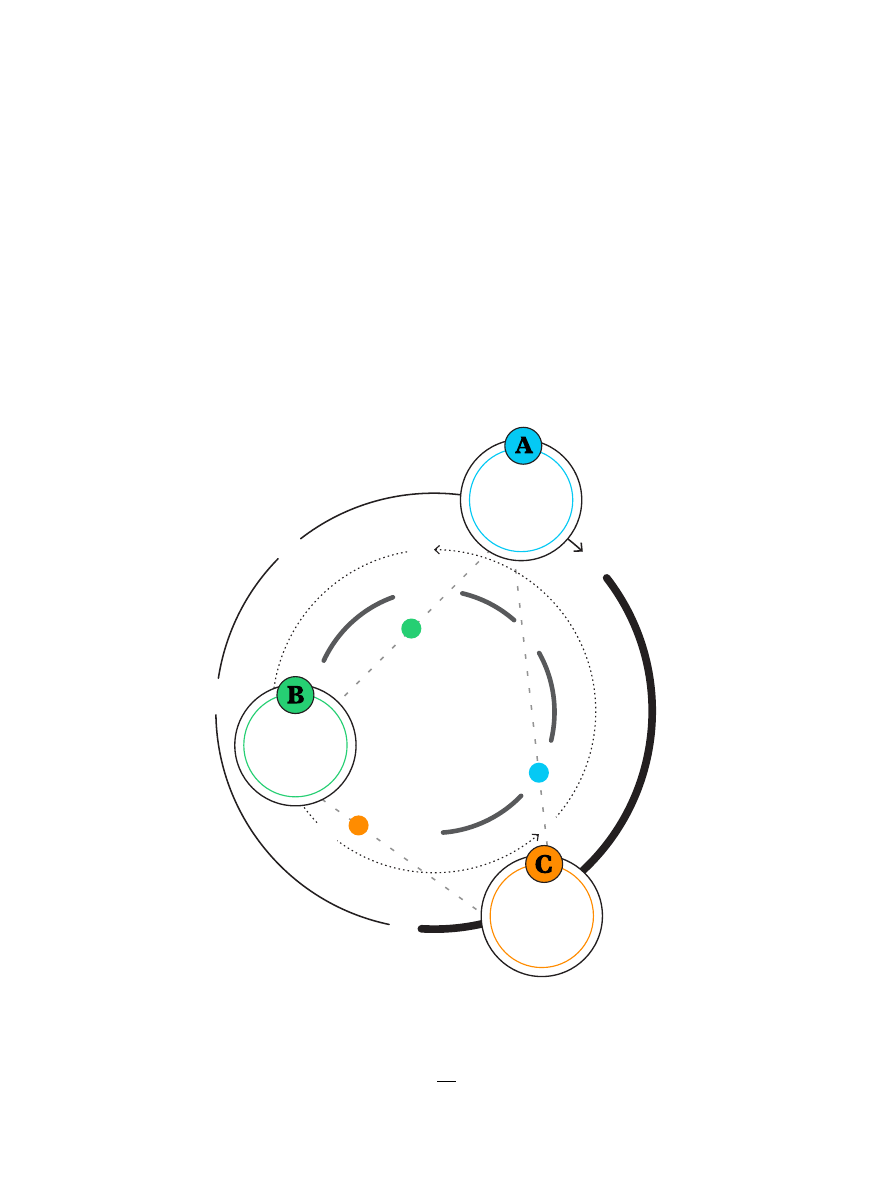

3.2 Project Guardian Pilot One

In the first pilot, our co-authors gained

first-hand experience in implementing DeFi

solutions in the financial markets, including

foreign exchange and government bond

markets. This section details the pilot’s

business objectives, design choices, and

the lessons learned to date.

3.2A – Business Objectives:

What did we set out to achieve?

Pilot One was led by co-authors DBS,

Onyx by J.P. Morgan, and SBI Digital Asset

Holdings. It sought to determine whether

tokenized real-world assets and deposits

could be transacted on a public blockchain

leveraging DeFi protocols, in a compliant

manner that preserves financial stability

and integrity. The intent was to explore the

delivery of traditional financial services

in a more open manner, fostering broader

participation in foreign exchange and

government bond markets through an

open and efficient ecosystem that attracts

liquidity providers and liquidity takers.

There were two workstreams in this pilot to

ensure comprehensiveness. Workstream one

focused on foreign exchange transactions

using SGD tokenized deposits issued by

J.P. Morgan and JPY tokenized assets

issued by SBI Digital Asset Holdings,

36

and

workstream two focused on the trading of

foreign exchange and government bonds

using tokenized cash (deposit) and tokenized

securities between entities of DBS and

SBI Digital Asset Holdings.

37

Transactions

under both workstreams were conducted

on public blockchain main net, focused on

technical and operational feasibility, and

participants established bilateral terms

and other controls to avoid actual financial

impacts, such as planned trade unwinding

for workstream one.

To fully assess the efforts needed for the

implementation of Institutional DeFi, the

pilot went through the complete lifecycle

from trade order placement, to trade

execution, token settlement and clearing.

Relevant business and operational teams

from front office to back office were

involved to assess potential gaps ahead

of the potentially scaled implementation

of Institutional DeFi, reducing adoption

friction and encouraging internal buy-

in. Transactions were executed using

modified public DeFi protocols and

leveraged Verifiable Credentials issued by

trust anchors to ensure transactions were

executed in a safe and compliant manner.

We illustrate the design choices made under

the four focus areas (see next page).

27

Institutional DeFi | Institutional DeFi Design in Action

Exhibit 9: Project Guardian Pilot Setup

Open, interoperable networks

Avoid fragmented and private

exchanges or markets

Pilot

Tokenized deposits & bonds

Issue and transfer tokenized assets

using a public blockchain

Pilot

Refined DeFi protocols

Adapt open-sourced protocols to

effect transaction terms

Pilot

Public blockchain

Deploy solution on public blockchain

for transactional activities

Pilot

Verifiable credentials

Issue digital Issue digital identities to

trade only with verified counterparties

Asset tokenization

Ensure operational feasibility of

asset tokens

Institutional-grade DeFi protocols

Mitigate market manipulation

and operational risks

Trust anchors

Ensure trading with verified,

trusted counterparties

Source:

Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, SBI Digital Asset Holdings

• A public blockchain, Polygon was

selected for its potential to allow higher

interoperability of tokenized real-world

assets and DeFi protocols, which allowed

participants to develop their own solutions

based on a set of agreed upon technical

standards.

• Trust anchors were developed to

ensure all trades were conducted within

a controlled, trusted environment. W3C

Verifiable Credentials issued by trusted

financial institutions were used to enable

compliant access to the DeFi protocols.

Verifiable Credentials consisted of tamper-

resistant information (identifiers and

metadata) that cryptographically attested

to the identity of the entity/person using

them. These credentials were developed

using W3C standards to reinforce Project

Guardian’s interoperability objective.

• The pilot leveraged tokenized assets

created by the co-authors across two

workstreams. In workstream one, Onyx

by J.P. Morgan focused on tokenized

Singapore dollar (SGD) deposits and

SBI Digital Asset Holdings focused on

tokenized Japanese Yen (JPY) assets.

In workstream two, DBS focused on

28

Institutional DeFi | Institutional DeFi Design in Action

tokenized SGD deposits and tokenized

Singapore Government Securities

(SGS), and SBI Digital Asset Holdings

focused on tokenized JPY deposits and

tokenized Japanese Government Bonds

(JGB). Our co-authors played unique

roles to complete bilateral trades within

these workstreams.

• Participants used modified public DeFi

protocols to conduct the transactions –

a lending and borrowing protocol (Aave)

was applied to a foreign exchange use case

in workstream one, and a decentralized

exchange protocol (Uniswap) was applied

to the trading of foreign exchange and

government bonds.

The pilot found that DeFi protocols have

potential to be adapted and tailored for

foreign exchange and government bond

markets activities on a public blockchain.

Further details of the pilot will be explored

in subsequent sub-sections. Continuous

improvements and testing of solutions are

on the horizon to better serve participants’

circumstances, needs and objectives. The use

of specific protocols by the pilot participants

does not constitute an endorsement of such

protocols by any author of this report. The

participants will continue to experiment,

both adapting existing protocols and building

new ones. Independent judgment should be

exercised in selecting an appropriate protocol

to suit any individual’s or organization’s

circumstance, needs, or objectives.

29

Institutional DeFi | Institutional DeFi Design in Action

3.2B – Design Choices: What did

we do to make DeFi work?

Among multiple design aspects, our co-

authors believe at least two were critical:

1) a trusted method to establish identity

for financial institutions to participate in

transactions against known and attested

counterparties on a public blockchain,

and 2) alignment on technical standards

underpinning interactions on the public

blockchain, using tokenized deposits

and assets.

1.

A trusted compliant method:

Trust anchors and Verifiable Credentials

were used to authenticate identity and

connect with existing legal frameworks.

Trust anchors were regulated financial

institutions that verified and issued

Verifiable Credentials to participating

traders, enabling them to transact on the

public blockchain. The trust anchors can

be viewed as the universal trust layer,

providing participants with a compliant

gateway to the Institutional DeFi solution.

The implementation of the trust anchor

mechanism was flexible and could

vary across institutions. For example,

authorized traders were issued credentials

by their parent institutions, through

various internal processes and credential

issuing software. These credentials were

attached to trade instructions to the DeFi

pool, and on-chain verification of these

credentials ensured that only instructions

with legitimate credentials were forwarded

to the DeFi pool.

2.

Alignment on technical standards:

Standards such as ERC-20 and W3C were

used to allow potential interoperability

among pilot participants.

The participants aligned on technical

standards to allow interoperability

between specific DeFi protocols and

existing legacy off-chain systems.

Interoperability also drove the choice

towards the use of ERC-20, the most-

common token standard in the Ethereum

ecosystem, to define token ownership,

supply, type of issuance, and data to

be stored on-chain, such as the token

name and ticker. Moving forward,

there may be other standards such as

ERC-1155 that could better represent

traditional instruments on-chain and

for trading. The Verifiable Credentials

were developed based on W3C standards

to enable participants to transact in a

compliant manner on a modified version

of the permissioned Aave protocol on the

Polygon network.

30

Institutional DeFi | Institutional DeFi Design in Action

Exhibit 10: Summary of Project Guardian Design Choices

Design choice

Rationales (non-exhaustive)

Blockchain

Network type Polygon

(public blockchain)

• Compliant with Ethereum Virtual Machine and could potentially

inherit data availability and security provided by Ethereum

Layer 1

• Strong developer ecosystem; Open-source DeFi protocol

resources available for feasibility assessment and rapid

development

• Instances of institutional participation on the network (or in

the ecosystem)

• Use of proof of stake (PoS) consensus ensuring less energy

consumption in validation

Data security

and visibility

Only wallet address

disclosed with

identity kept

confidential.

Transaction data

stored in public

blockchain with no

details disclosed

to non-participants

• Fulfil the purpose of pilot and experiment data security and

visibility on public blockchain to prepare for scalable adoption by

the industry

• Minimize identifiable data on-chain in a controlled environment

to avoid leakage of confidential data to public during the Pilot

31

Institutional DeFi | Institutional DeFi Design in Action

Participation

Deployment

Assurance-based

model, authorizing

only pilot participants

to deploy modified

open-source smart

contracts, such

as permissioned

version of Aave,

to interact with

other participants

• Developers are limited to pilot participants, who are known

regulated entities and individuals

• Institutional-grade development standards were applied to

aid client protection, such as smart contract audits, Verifiable

Credentials of the participants, and product/code management

process

• Potential for rapid parallel developments by leveraging

composable DeFi protocols, reducing time and cost of innovation

Access

and usage

Trust anchors

verify and authorize

participants, using

W3C-based Verifiable

Credentials (VCs)

• Participant firms function as trust anchors to run Verifiable

Credentials (VCs) issuance software to issue VCs to

authorized traders

• VCs were held by traders in custom-built wallets. The wallets

enabled VCs to be attached to trade instructions and on-chain

verification ensured only instructions with legitimate credentials

were accepted

• The smart contract system was designed to enable use of VC

verification without requiring the DeFi protocols to be aware of

the actual credentials, thereby enabling the use of this system

with a wide variety of DeFi protocols “out of the box” for future

scaled adoption. The verification of VCs was done on-chain by

smart contracts before being forwarded to the DeFi pool

• The issued credentials followed a chain of trust, every authorized

trader credential (including various control mechanisms such as

trading limits) was irrevocably anchored to a trusted entity

• Traders never had direct access to firms’ funds. The solution

enabled verification of traders’ identities on chain, based on

which they were authorized to trade on the application

• These Verifiable Credentials could be revoked. Upon revocation,

traders would be prevented from trading

• The use of W3C open standards ensured that the implementation

aligned with Project Guardian’s interoperability objective

32

Institutional DeFi | Institutional DeFi Design in Action

Token Design

Token

issuance

Multiple issuance

approaches were

taken, such as

• DBS issuing

tokenized SGD

and non-native

Singapore

Government

Securities

(SGS) tokens

• J.P. Morgan issuing

native Singapore

dollar deposits

(SGD) tokens

• SBI issuing non-

native Japanese

Government Bonds

(JGB) tokens

• The use of tokenized form enables interactions with DeFi

protocols for real-world assets, and the use of different token

issuance approaches can test the interoperability of tokens

issued by different mechanisms and players, e.g.:

− Different token structures were used for payments, including

DBS’s tokenized SGD representing tokenized cash against

customer deposits; native deposit tokens such as JPM’s

tokenized SGD deposits (evidence of demand deposit claims

for fiat amounts against the issuing bank, in native token form

on blockchain, as an alternative to recoding balances in a

demand deposit account (DDA) in traditional ledger system);

and SBI’s non-native JPY assets (claim against a non-bank

issuer for an asset held with a third-party bank)

− Tokenized securities experimented included non-

native tokenized SGS and JGB, which were designed as

representations of underlying assets and not as standalone

securities, value of tokens anchored to the value/price of

underlying assets

Settlement

recognition

On-chain atomic

settlement finality

without intermediary,

followed by off-chain

ledger update (for

reporting purposes)

• Integrated with legacy trading systems and processes for

governance and controls

• Enhanced transaction transparency and traceability, and the

blockchain deemed to be the definitive record of trades

• Underpinning legal agreements deemed to be determinative

in the event of any dispute, in the absence of established

regulations

• Off-chain record for reporting purpose

Token

standards

ERC-20

• ERC-20 is a recognized standard that 1) could work with multiple

existing open-source DeFi protocols, 2) ensures tokens are

fungible when minted by same issuer/smart contract

• Note: There is a potential to explore other standards (e.g., non-

fungible token standards) for better on-chain representation

and trading

Source: Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, SBI Digital Asset Holdings

33

Institutional DeFi | Institutional DeFi Design in Action

3.2C – Lessons Learned to date:

What needs to be done to reach

scale?

Scaling the solution to benefit global

financial markets will require more work.

From experience with Pilot One to date, our

co-authors have jointly identified seven

areas that would need broader industry

efforts to build the scalable foundation

for Institutional DeFi offerings.

#1 Legal clarity on frameworks

Participants need to actively identify areas

that need clarity within the prevailing legal

and regulatory framework and engage with

regulators and legislatures to drive regulatory

and legislative solutions that account for this

new financial environment enabled by the

new technology. These efforts should address

issues such as recourse mechanism, on-chain

settlement treatment, KYC and AML, usage

and holding of crypto-assets, and legal and

accounting treatment of business activities:

• Recourse mechanism: Existing legal

recourse and dispute management

processes may be insufficient to address

potential disputes in a blockchain

environment in the absence of separate